KENNESAW, Ga. | Dec 5, 2025

As we close out another year, we are often prompted to think about giving. From the bell ringer at the department store to larger gifts that include a comma (or two) when you write the check, philanthropy can take many forms. For family businesses, there are even more layers to those decisions.

Philanthropy isn’t just a charitable act when it comes to family businesses. It’s a reflection of values passed down through generations. Giving back often becomes a way to honor those who built the business while shaping the kind of future the next generation will inherit. So how can you give with purpose?

Like many things in family business, conversations should drive your giving strategy. Ask family members AND non-family employees to share what causes matter to them, the stories behind those passions, and how they see a gift making a difference. These discussions often reveal shared values like service, stewardship, and community that become the foundation of your giving approach.

Next, define your goals. Are you hoping to pour into your local community, support veterans, or shine a light on environmental initiatives? Clear focus helps ensure that your philanthropy is aligned with your family’s identity and that your resources are thoughtfully directed.

If possible, consider creating a structure for your giving, whether that’s a family foundation, a donor-advised fund, or an annual philanthropic plan tied to your business calendar. This also better equips you to measure your impact and adjust over the years.

Finally, share it! As shown in the recent Family Business Perception Report, family businesses are "not widely recognized for their broader societal contributions," and can unintentionally appear less engaged in giving back. We discussed this in a recent webinar with Katie Rucker and Jenny Dinnen, twin sisters and co-presidents of MacKenzie and Next Gen Collaborative, who led the study. Sharing your impact isn’t boasting—it’s helping others understand the values that guide your family business and the difference you strive to make.

When families approach philanthropy with intention, they turn generosity into legacy—one meaningful action at a time.

Want to learn more? How Business Families Can Invest for Social Impact

The original Christmas tree lot began in 1949 as a way for "Big John" Livaditis to supplement Zesto Drive-Ins during the cold winter months when ice cream sales were down. It has grown into a three-generation business rooted in hard work, stewardship, and community connection.

Today, second-generation president Jimbo Livaditis and his three adult children personally source the trees each year while creating a welcoming experience built on the same values that guided Big John decades ago. Jimbo's wife, Leigh Ann, serves as vice president.

As longtime members of the Family Enterprise Center, Big John’s reflects the impact family businesses have on local communities by creating continuity, bringing people together, and shaping traditions that span decades. We’re proud to celebrate their legacy—and cheer them on as they continue spreading holiday joy throughout Atlanta!

While the holiday season inspires generosity, not everyone is in a position to make a financial gift. Fortunately, some of the most meaningful contributions don’t require writing a check—they include showing up with time, energy, and care. For family businesses, these forms of service can strengthen company culture, deepen family connection, and create visible impact in the communities they call home.

Here are several ways to give generously without a monetary donation:

When families and businesses give in ways that reflect who they are, they demonstrate that generosity is not measured only in dollars. It’s measured in compassion, presence, and the shared commitment to lifting others up.

Looking for a local partner? Must Ministries has been serving metro Atlanta since 1971 through programs that provide housing, food, clothing, workforce development, and healthcare. Must Ministries also collaborates with Kennesaw State University through the ACE Program (Aspiring Community Entrepreneurs).

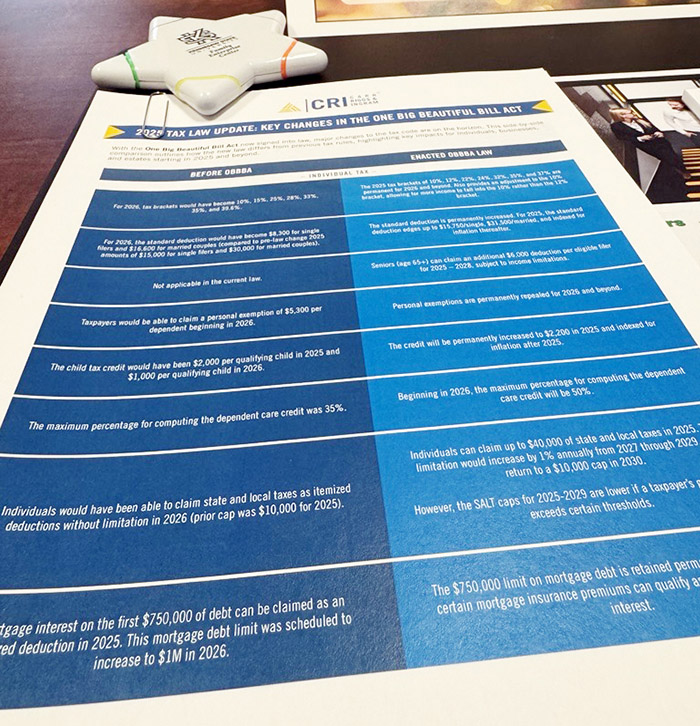

A key takeaway was this practical, easy-to-reference guide summarizing important changes. Additionally, for a more in-depth article regarding small business deductions and limits, read here.

Angel investing didn’t begin in boardrooms or venture capital circles. Its earliest roots trace back to early-1900s Broadway, where private backers—nicknamed “angels”—quietly funded productions that would never have made it to the stage without them. They weren’t chasing outsized returns. They were supporting their community, nurturing creativity, and giving new ideas a chance to live.

More than a century later, angel investing has grown into a formal asset class with $25–30 billion flowing annually into early-stage companies across the U.S. Yet even as the structures have become more sophisticated, the heart of angel investing remains unchanged: helping something meaningful take its next step.

Today, many established family businesses are rediscovering angel investing as a natural extension of their philanthropic footprint. New platforms and regulations allow individuals and closely held companies to contribute smaller amounts—often between $1,000 and $5,000—making participation more accessible while spreading risk. And the motivation is evolving. Angel investing is no longer only a financial strategy; for many business leaders, it’s a values-based one.

For established family enterprises, angel investing can be a powerful way to deepen community impact by:

Angel investing isn’t charity, and it isn’t traditional investing—it sits in the space between, where belief, responsibility, and opportunity meet. For family businesses with a strong sense of place and purpose, identifying as angel investors can be one more way to live out long-standing philanthropic goals.

Angel investing began as an act of community. For established family businesses, it can still be one today—and one more avenue for shaping a thriving future.