KENNESAW, Ga. | Jul 9, 2025

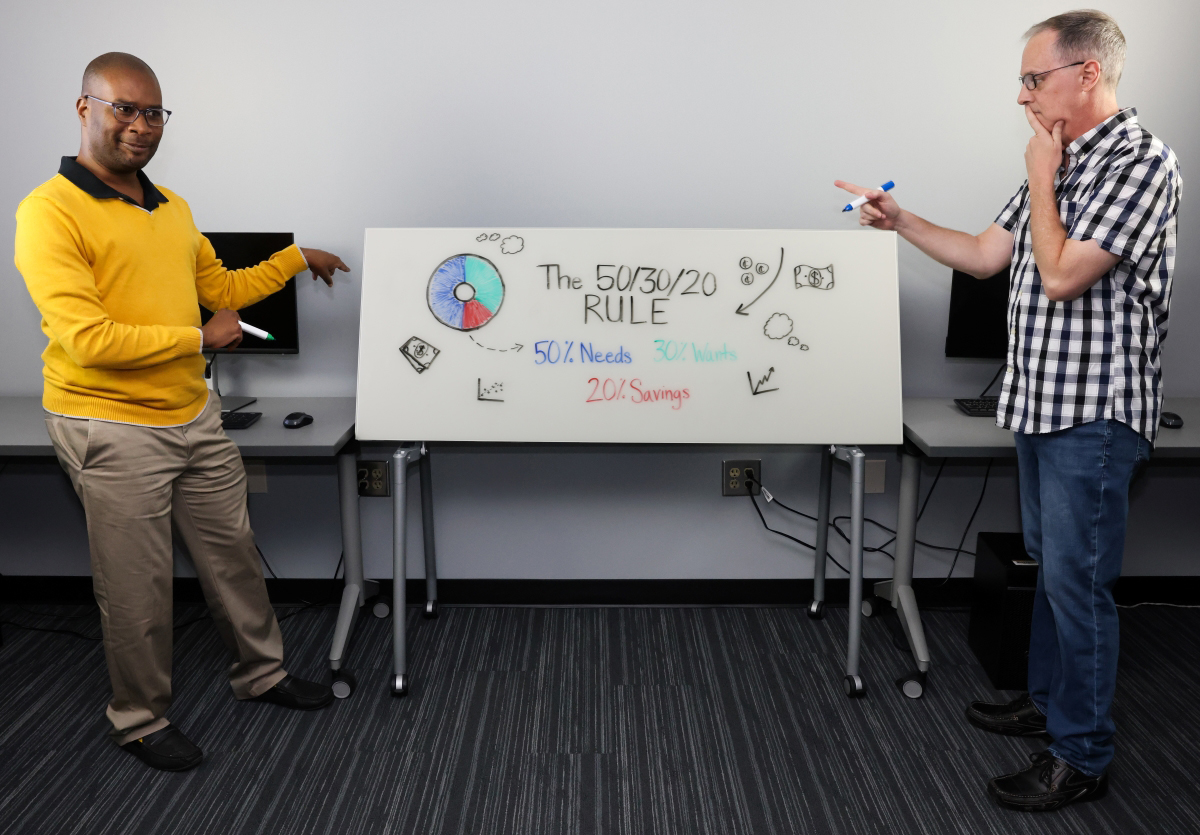

Limited-Term Instructor of English Jeffery Jackson and Senior Lecturer of Geography Matt Waller illustrate some of the financial literacy concepts that students learn in the modules. (Photo/Noelle Lashley)

The Norman J. Radow College of Humanities and Social Sciences Faculty Financial Education Innovators program is growing, and faculty are finding innovative ways to weave financial literacy into their classes across a variety of subject areas.

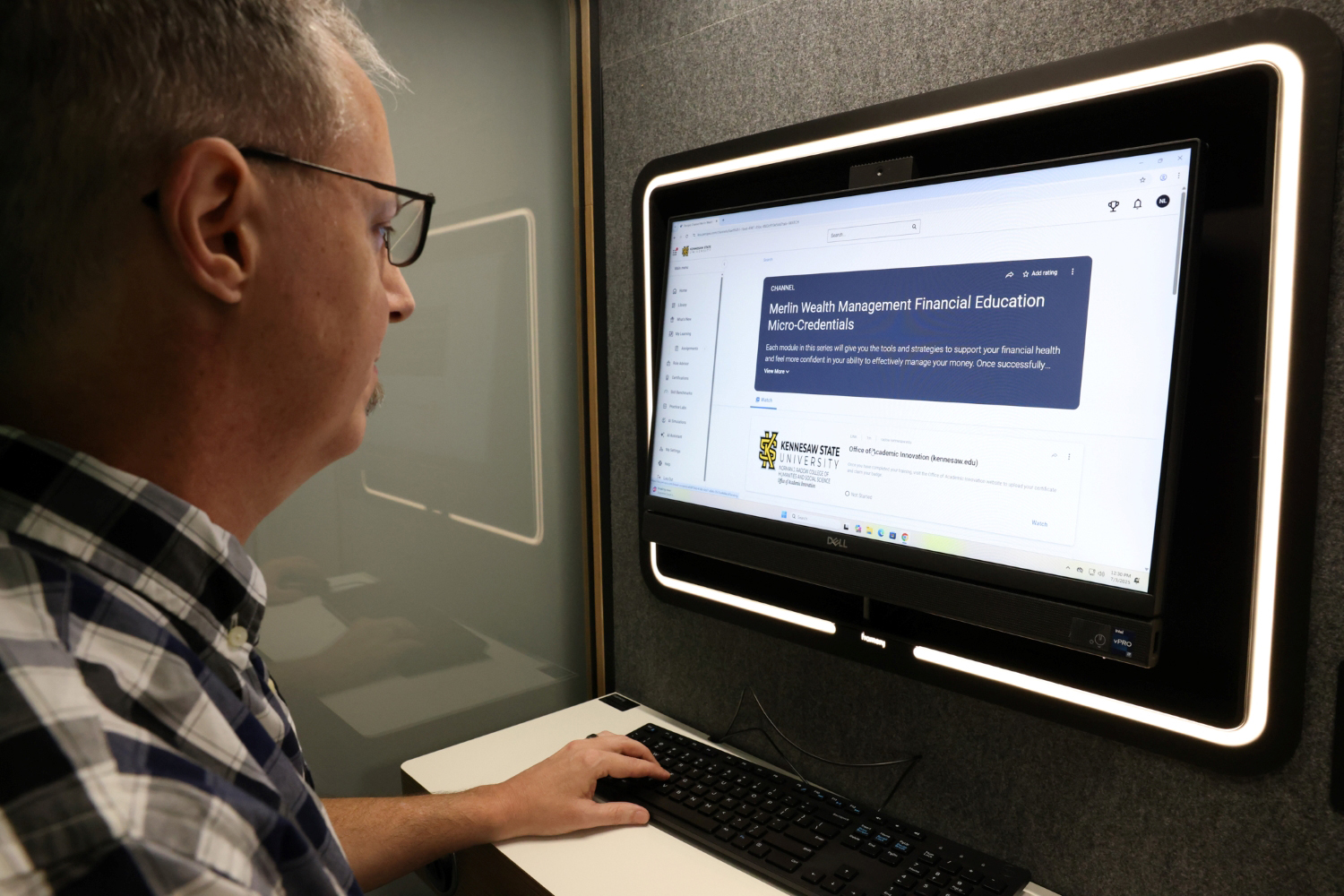

The program, which was developed and managed by the Radow College Office of Academic Innovation, is made possible by the Merlin Wealth Management Gift for Financial Education. The Merlin family’s gift provides one-time financial support of $500 to faculty who incorporate financial education principles into their classes and meet all program requirements. Faculty can include up to eight Merlin Wealth Management Financial Education micro-credentials on financial literacy topics relevant to students. Those include Understanding Income, Spending Habits, Budgeting Basics, U.S. Taxation Basics, Introduction to Financial Planning, Fundamentals of Investing, Decoding Student Debt, and Finance Basics for New Graduates.

The number of faculty involved in the program has doubled since its inception in Fall 2024, according to Kris DuRocher, Ph.D., Associate Dean of Academic Affairs – Curricular Innovation and Enrollment Management. Faculty from seven of the college’s 11 units have participated as of June 2025, and DuRocher said that incorporating these lessons has a real-world impact.

“We see tons of data that show how students who receive financial literacy go on to be less likely to be a victim of fraud. They go on to have more of an ability to make sound financial decisions [and] set financial goals for themselves, so we see a lot of positive impacts down the road connected to early financial literacy,” she explained.

DuRocher has seen some faculty start with one or two Merlin Wealth Management Financial Education micro-credentials, then come back and add more. She said the wealth of experience and expertise within Radow College, combined with these financial literacy tools, will help students be prepared to enter the job market, negotiate their salaries, read their first paycheck, calculate potential taxes, understand the difference between retirement plans, and lead financially healthier lives. Faculty members who incorporate the micro-credentials also integrate students’ participation into their grades, whether that’s through a boost to their participation grade or as an extra credit opportunity.

DuRocher is also glad to see Radow College faculty tapping into their creativity when it comes to helping students engage with the material – especially in courses that don’t seem to naturally pair with financial literacy.

“As a historian, to me, I was... kind of literal in the way that I was interpreting this, but seeing all the cool ways that our faculty have integrated this into their courses and then continue to find new ways to integrate and expand the way the micro-credentials are incorporated into their courses has really been one of the most exciting things,” DuRocher explained.

For example, Mandy Guitar, Ph.D., a psychology lecturer, incorporates the Merlin micro-credentials into her Intro to General Psychology class. During her class unit on sensation and perception, she uses the program’s tools to help students understand subliminal marketing tactics and how they can encourage detrimental financial decisions. She also explains the mental and physical impacts of financial stress when her course covers health and well-being.

Guitar has already received the one-time financial support for participating, but she said that the micro-credentials provide such helpful training for her students that she will include them for a second time this fall. “I think the financial incentive is obviously a great tool. It gets somebody to... be motivated to look into it in the first place, but once I used it, I realized how much it did weave in,” Guitar said. “I would feel like I’d be losing something now if I didn’t continue to include it.”

She said the program inspires her to think creatively and to give her students extra tools with a real-world impact, regardless of whether they go on to be psychology majors. Her favorite tie-in is during her course module on thinking, which leads to enlightening class discussions on how our thinking patterns are connected to overspending.

Senior Lecturer of Geography Matt Waller looks through the list of Merlin Wealth Management Financial Education Micro-Credentials offered through Radow College’s Office of Academic Innovation. (Photo/Noelle Lashley)

“It seems to click with them, and they realize for some of them that doing this overspending.... might be tied to this kind of overarching psychological concept that we discussed in class,” Guitar said. “Anytime those clicking moments happen, those are just... that’s what you hope for as an instructor.”

Matt Waller, a senior lecturer of geography, will also be a repeat participant in the program for the Fall 2025 semester. He explained that financial literacy and geography make a natural pairing. He plans to incorporate the budgeting basics, decoding student debt, and spending habits micro-credentials into his upcoming Introduction to Human Geography course — topics that he says pair well with his course discussions on economies and development. “Economics is a social science. Teaching about how people in different places see money... that’s kind of a no-brainer,” Waller said.

His background in academic advising means he’s helped students navigate challenges ranging from their coursework to their finances to their futures. He believes that incorporating financial literacy into humanities and social sciences coursework is an important step toward helping students become educated citizens. “Students need it. They’re not getting it anywhere else,” Waller explained. “Is that not the purpose of higher education? To fill in gaps of knowledge?”

Meanwhile, Jeffery Jackson, a limited-term instructor of English, will be a Radow College Faculty Financial Education Innovator for the first time this fall. He describes himself as a “non-traditional English teacher” who loves innovation and real-world applications in his English Composition I class.

(From L - R) Limited-Term Instructor of English Jeffery Jackson, Associate Dean of Academic Affairs – Curricular Innovation and Enrollment Management Kris DuRocher, Radow College Dean Katie Kaukinen, and Senior Lecturer of Geography Matt Waller pose for a photo on July 3, 2025. (Photo/Noelle Lashley)

He plans to incorporate the unit on Understanding Income when he encourages students to explore “their pathways to possibilities” in his class. He encourages students to examine their majors and the different paths they can take, and by incorporating this micro-credential, they will develop a sample budget for the future based on the pathway they choose.

“I’m thankful for the opportunity to include other resources. I definitely know that this... Merlin Financial micro-credential will impact the students not only knowledge-wise, but it will definitely give them a head start. Because when you think about it, how many parents are actually talking to their children about financial literacy? See, and then how many other places are we getting this financial literacy [from]? So this is actually, this is a gift to us. I’m glad to... be an ambassador of the gift to pass it on,” Jackson said.

Radow College faculty who are interested in becoming Faculty Financial Education Innovators for future semesters can view program requirements and apply here.

—Story and photos by: Noelle Lashley